In recent years we use many types of methods to pay for goods and services that we require like using money, cryptocurrency, etc.

But before money existed, people used different methods to trade for goods and services like the Bartering system. Bartering is a process of trading goods and services with other goods and services instead of money.

Although the Bartering system started by the Mesopotamians back in 6000 B.C. had its advantages, where we could trade services for goods, it was not always a feasible option.

For example, if you would like to trade your horse for a bag of rice, the other trading party may not accept the deal as the trader may not want a horse but something else that is useful for them, and thus both parties may come to disagreements.

This led to the development of a monetary system in which goods and services could be traded using items that are referred to as money like printed paper money or coins.

Unlike Bartering, a system where goods of equal worth were exchanged in a monetary system, the items referred to as “money” often have little or no value in respect to the item itself. For example, the paper used to print money has no particular value.

Money has value because it is a chosen exchange medium by the people. When everyone deems that a bill or a coin has a value, then it can be used as a form of payment to exchange goods and services.

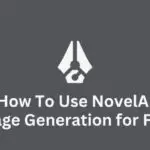

But, people won’t recognize just any piece of printed paper as money if they aren’t authorized by banks or governmental organizations. The reason is simply that people trust banks or governmental organizations to hold their money.

If you look closely at a printed banknote, you will be able to find that the authorized governmental organization promises the bearer of that note the amount of money mentioned on the note thus deepening the trust between the two parties.

Currently, in the 21st century, the advancements in our technology have given rise to more novel forms of currencies: mobile payments and virtual currencies.

Mobile payments are payments made through a specific application for goods or services through a portable electronic device like your mobile phone, tablets, etc.

Virtual currencies are online currencies that have no physical appearance but can be used just like money to buy goods and services online.

Now, let’s understand more about these virtual currencies otherwise known as cryptocurrencies.

What is Cryptocurrency?

Cryptocurrencies are digital currencies that can be mainly used for online transactions to buy goods and services. As the name suggests, “crypto-currency” is a form of digital currency that uses online ledgers with strong cryptography to make online transactions secure.

Many companies have issued their currencies which are also called tokens. We can use these cryptocurrencies to exchange tokens and buy goods and services from the company.

Cryptocurrencies are completely virtual where the record of your money balance and expenditures are stored in a spreadsheet. It uses a technology called blockchain to operate.

Blockchain is a public digital ledger of transactions that stores information on each transaction in a block and is linked with other blocks to form a chain. This information is stored in multiple computers thus making it difficult to be tampered with.

How do cryptocurrencies work?

Cryptocurrency like Bitcoin uses blockchain mining to operate. It is a currency that has no physical appearance and only its balances are kept on a digital ledger that everyone has transparent access to.

All virtual currencies are verified using a massive amount of computer power. Blockchain mining is done by a collection of computers.

Each computer is referred to as a “node” or “miner”. It runs a mathematical code and stores the blockchain. Blockchain as mentioned earlier is a collection of blocks stored with information.

All miners or nodes have the same list of blockchain and it keeps getting updated in real-time when a new transaction is done.

But, because all miners have a blockchain with the same list and can see new blocks getting added transparently, it is quite difficult to conduct fraud using virtual currencies. Essentially, no one can cheat the cryptocurrency system.

Key features of cryptocurrency

Cryptocurrencies use advanced cryptography which is primarily based on mathematical theories. It uses cryptography that helps to generate cryptographic puzzles that enable data mining.

There are two main elements of cryptography that is applied to the procedures while trading using cryptocurrency and they are:

- Hashing: This procedure verifies data and maintains the structure of the blockchain. It encodes people’s account details and transactions. This enables users to transact using bitcoins anonymously.

- Digital signatures: This helps cryptocurrency users to own their encrypted information and helps them to transact without revealing their information. This is also used to sign monetary transactions made for online trades.

What makes cryptocurrencies so popular?

The below-given points are some of the reasons why cryptocurrencies are popular among their investors:

- Cryptocurrency is decentralized which means that there are no third parties involved in the transactions done between two parties.

- The value of centralized money could decrease over time due to inflation.

- Since it uses blockchain technology, transactions could be more secure than the traditional payment systems.

- Investors of virtual currencies see these assets as the currency of the future. Therefore, they are racing to buy these coins before they become more valuable.

Advantages of using cryptocurrency

There are quite some advantages of using a cryptocurrency as payment. Here are some of them:

- Discretion: Bitcoin purchases are always discreet. Purchases made by these currencies are never associated with personal identity.

- Peer-to-peer focus: The payment system of virtual currencies focuses mainly on the respective paying and trading party without requiring any approval from an external authority.

- Decentralized payments: It means that payments done through virtual currencies do not involve any banking fees or external charges like exchange rates or interest rates, thus allowing the trade process to go smoothly.

- Accessibility of a cryptocurrency: users are able to conduct trade with only a smartphone or computer.

What are the different types of cryptocurrencies?

Rather than the term “cryptocurrency”, many of us have mostly heard the term “Bitcoin”. Bitcoin is a type of cryptocurrency and there are more than 10,000 different types of virtual currencies traded every day.

Out of these types, there are currently 10 virtual currencies that are the largest trading currencies by market capitalization (according to CoinMarketCap.com, a market research website).

These coins are Bitcoin, Ethereum, Tether, Binance coin, Cardano, XRP, Dogecoin, USD Coin, Polkadot, and Uniswap.

Bitcoin is the first and the largest cryptocurrency released in 2009 by a pseudonymous person or group named Satoshi Nakamoto.

To know more about the prices of different cryptocurrencies, check the Coin Market Cap website.

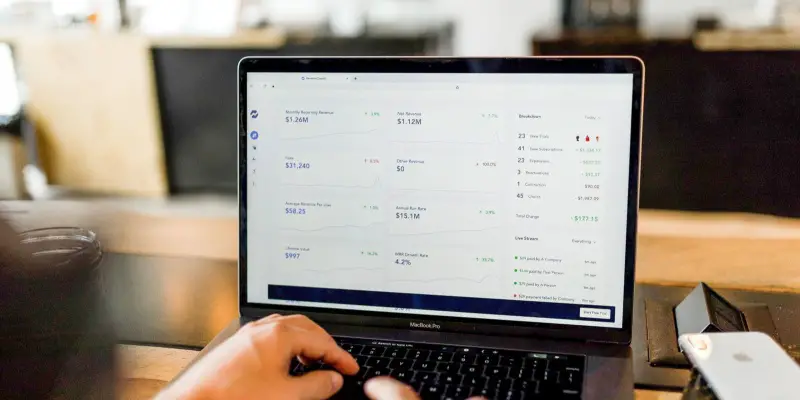

How to Invest in Cryptocurrencies?

Some cryptocurrencies are available for purchase with the U.S dollar, while others may need to be purchased with bitcoins or other virtual currencies.

To buy and store a cryptocurrency, you will need an online app named “wallet“. First, you will need to create an account on the app and then it allows you to transfer real money to buy cryptocurrencies.

However, you need to keep in mind that although cryptocurrencies are referred to as the future of currency in the coming era, it is a volatile asset.

Therefore, there are chances that its value may increase or decrease over time. Although virtual currencies generate no cash flow which means that if you require to profit from the virtual currency then someone has to pay more for the currency than you did.

Safety precautions you need to take while investing in Crypto

If you are looking to invest in bitcoins or any other cryptocurrencies such as Litecoin, Cardano, Ripple, etc., then it would be better if you could take the following precautionary methods.

- It is important to develop a sense of how cryptocurrencies work before investing in them. Therefore, it would be advisable to learn more about the different currencies available.

- Research and see if any other major investors are investing in the currency of your choice. It could be a good sign that more people might be interested in them.

- Remember that virtual currencies are highly volatile and might give you the best desired result all the time. Therefore, think twice before you invest in them.

- Virtual currencies are only accepted as payments in a few companies, thus spending using cryptocurrencies becomes difficult.

As Bitcoins progress in their market share, and cryptocurrencies like Ethereum bring forward a collection of financial products that every customer of today might need, cryptocurrencies are becoming more a reality and less an intangible asset.

Gone are the days where only the technologically gifted would pursue currencies, as companies, the news, and its own potential has now rocketed it to popularity.

Even with the volatility, the promise of the future that cryptocurrencies hold has become synonymous with the definition of financial progress in a country.

With due information and keen sight for the market, you too can become a successful investor in cryptocurrency!